Creating additional value by optimizing agriculture and solar.

by Matt Pickens, Sr. Managing Director | March 2024

The Sower Farmland Fund seeks to provide Accredited Investors with stable income and inflation protection through a diversified portfolio of investment-quality, U.S. row crop farmland. In addition, U.S. farmland has shown low or negative correlations to returns of stocks and bonds, offering attractive diversification benefits. As we closed out the 2023 year and entered 2024, we surpassed $100M in assets under management (“AUM”) for the Sower Farmland Fund. Furthermore, we successfully concluded three full years of operation with a return since inception that exceeded the NCREIF benchmark for the fund. These two milestones, in addition to the current landscape of opportunity, provide for a robust opportunity set over the next 12+ months.

The Sower Farmland Team has extensive experience in farmland ownership and acquisition throughout the United States and is committed to long-term value creation through strategic asset acquisition and management plans.

The Sower Farmland Team has extensive experience in farmland ownership and acquisition throughout the United States and is committed to long-term value creation through strategic asset acquisition and management plans.

Sower Farmland acquired the Okolona Farm through its Sale-Leaseback process. This allowed for an off-market acquisition at a below-market price.

Commanding an attractive rent rate, the Okolona Farm has recently undergone pattern tiling improvements on nearly 800 acres. It is situated close to local markets, which provides a positive corn crop basis. It has three 30,000-bushel grain bins that offer addition annual income.

The presence of a transmission line through the property holds potent opportunity for a solar contract on the farm. This income diversification project will increase the farmland value and return to our investor partners. It is anticipated that 153 acres will be outfitted with solar panels that will bring an estimated future market value of $1,660,250 and a three-year IRR of 40%.

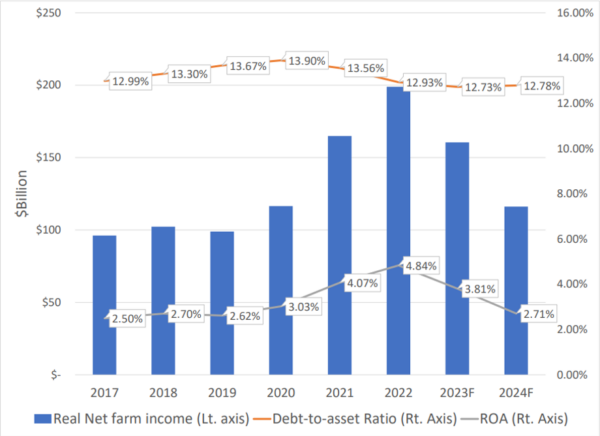

As we continue our pursuit of additional acquisitions for the fund, we’re mindful of the economic headwinds and tailwinds that exist to drive opportunity. There has been a lot of discussion in the press regarding the large year-over-year drop-off in farming income (estimated to be approximately 25%). Although this decline is substantial, we believe that this merely reflects a mean version to the long-term average in real terms as depicted in the graph below. Given the low level of farmland debt, it is unlikely that this change in income will cause significant distress in the farming sector, however, it likely does create a unique investment window for institutional owners of farmland like Sower to have an opportunity to enter assets at reasonable price points with room for future upside.

Learn more about Sower Farmland.